For many of our clients the recent failure of Silicon Valley Bank (SVB) hit close to home. While still evolving, there is plenty of speculation as to what might come next. One recent development is that government officials from the Treasury, Federal Reserve, and Federal Deposit Insurance Corporation (FDIC) have announced that depositors will be made whole in an effort to restore confidence.

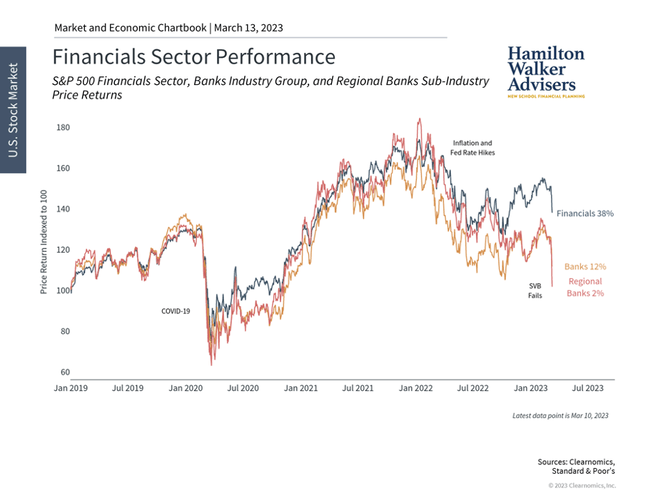

The collapse of Silicon Valley Bank (SVB) was the first FDIC-insured bank failure since 2020 and the second largest in history.

What can we do to protect ourselves?

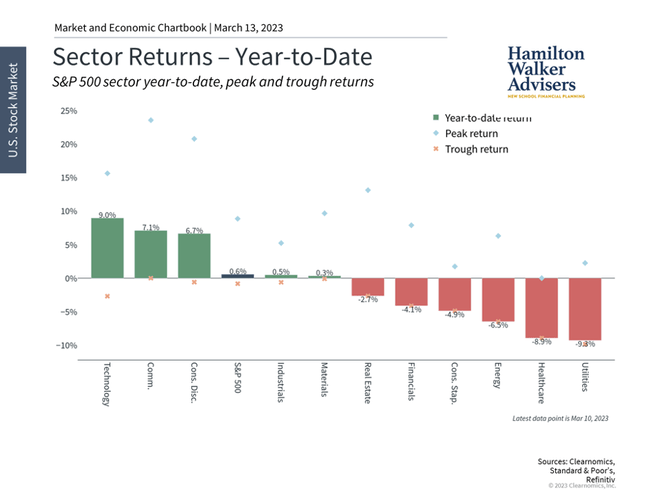

From a capital markets perspective, diversification across a variety of sectors is something we continue to believe in as an effective way to mitigate risk. From an economic perspective, the question remains whether we will see wider contagion across the financial system.

How do bank runs occur? A simplified description of the banking model is that customers – both businesses and individuals - deposit funds for safekeeping. Banks then use these deposits to make loans or to buy high quality investment securities which they hope can generate profits. This works well as long as these investment assets maintain or grow in value and customers trust that their deposits are safe. If either of these is not the case, a bank may not have the liquidity to meet its obligations and a loss of customer confidence may cause withdrawal requests to be made before the bank can recover its losses.

Naturally, there are parallels being drawn to 2008 when the last wave of bank failures threatened the global financial system. It's important to keep in mind that, back then, the problem was not just that all banks held significant amounts of mortgage-backed securities and other housing-sensitive assets that ended up being worth only pennies on the dollar. Rather, significant amounts of leverage coupled with new financial instruments such as collateralized debt obligations allowed a housing crisis to turn into a financial meltdown. While it's unclear exactly how this episode will play out, many banks today are much better capitalized and do not primarily rely on tech or crypto deposits.

A silver lining? Congruent with market-based measures, investors no longer expect the Fed to raise rates again this year, but instead believe that there may be a rate cut by September. While these expectations can change rapidly, it is reflective of how much sentiment has shifted.

The bottom line? While recent bank failures are problematic, parallels to 2008 are premature. Investors should stay diversified as the situation stabilizes, while focusing on the big picture rather than minute-by-minute speculation. Make sure you have FDIC coverage on any banking instrument you are using. Contact us if you have concerns or questions.